No technical expertise is required. The SOF Agent is designed for property professionals and compliance teams, not IT specialists.

The interface is intuitive and requires minimal training:

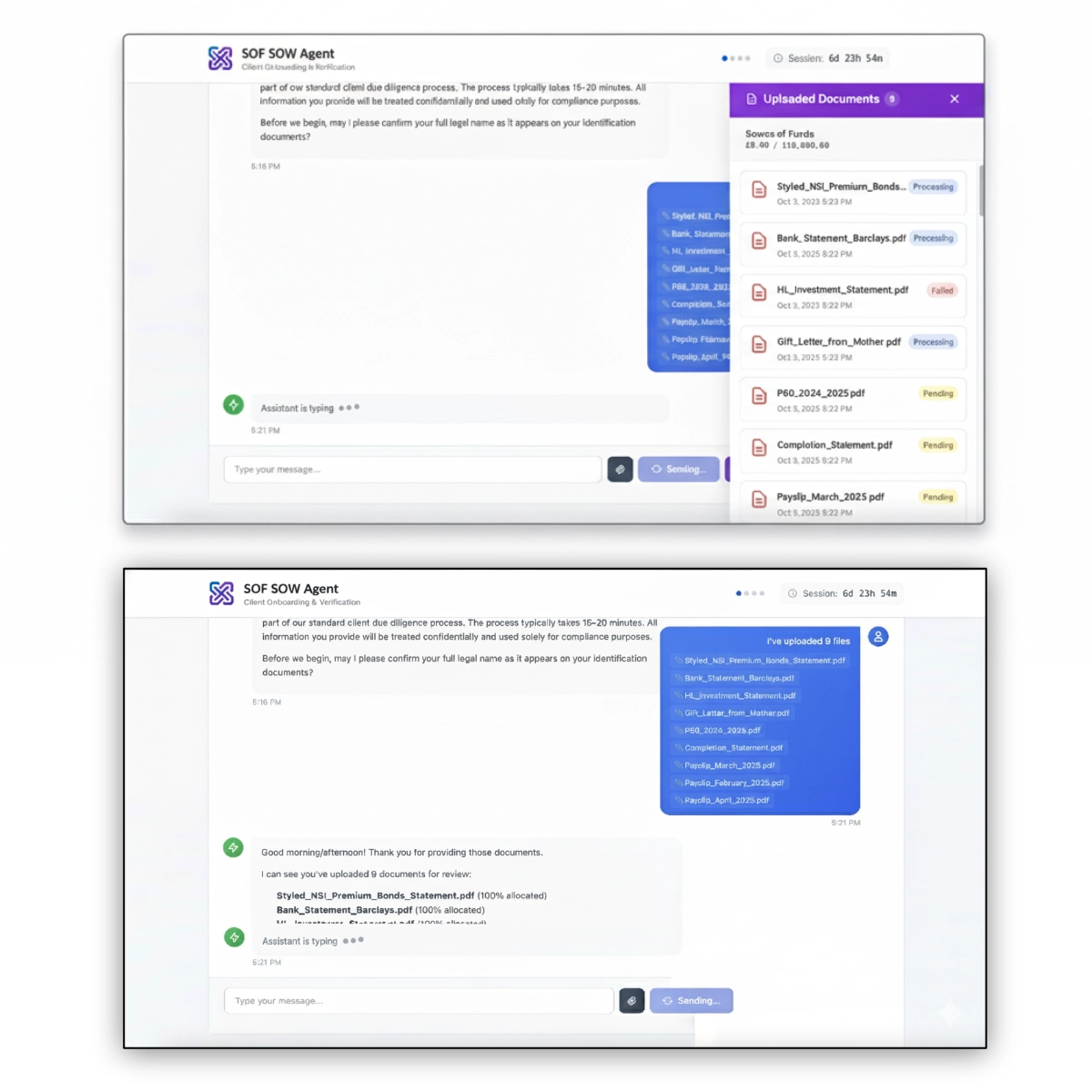

- Upload documents or connect directly to case management systems

- Review automated verification results in a clean dashboard

- Approve, query, or request additional information with one click

- Generate compliant reports automatically

Most users are fully proficient within their first few cases. Our training typically takes just 2-3 hours, and we provide:

- Video tutorials and documentation

- Live support during business hours

- Ongoing training resources

- Dedicated customer success manager

Your IT team only needs to be involved during initial setup for system integrations, if applicable.